What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

What is an ITIN used for?

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting.

An ITIN does not:

Authorize work in the U.S.

Provide eligibility for Social Security benefits

Qualify a dependent for Earned Income Tax Credit Purposes

Who needs an ITIN?

If you do not have an SSN and are not eligible to obtain an SSN, but you have a requirement to furnish a federal tax identification number or file a federal income tax return, you must apply for an ITIN. By law, an alien individual cannot have both an ITIN and an SSN.

ITINs are issued regardless of immigration status because both resident and nonresident aliens may have U.S. tax return and payment responsibilities under the Internal Revenue Code.

With an ITIN:

- File taxes in the United States

- Open a U.S. PayPal account

- Open a Stripe account for online businesses

- Open a U.S. bank account

- And more!

In order to be eligible for ITIN, you must fall into one of the following categories:

Non-resident alien who is required to file a US tax return US resident alien who is (based on days present in the US) filing a US tax return

Dependent or spouse of a US citizen/resident alien. Dependent or spouse of a nonresident alien visa holder such as H4 visa holder. Nonresident alien claiming a tax treaty benefit Nonresident alien student, professor or researcher filing a US tax return or claiming an exception.

How To Apply For ITIN From India or Anywhere in the World? How to Obtain an ITIN Number? – Application

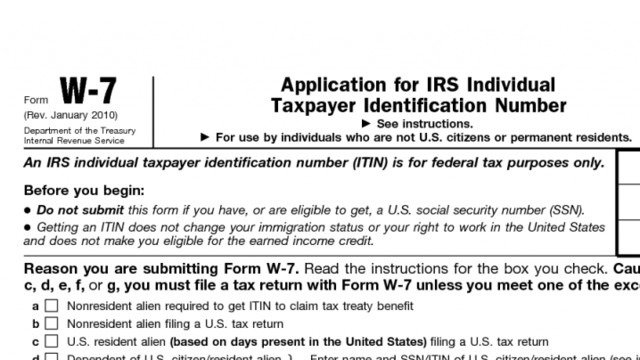

ITIN is a nine-digit number formatted similarly to the SSN. To apply for an ITIN, you must complete the Application form for IRS Form W-7, IRS Individual Taxpayer Identification Number. This one-page application requires:

Name and birth of name (if different)

Date and place of birth

Identity documents to accompany the application, such as a passport, driver’s license or government issued ID

Foreign status or immigration documents in original forms or certified copies

If you have used an ITIN in the past, you must provide a predefined ID number in your application.

No matter where you live in. You can apply for an ITIN from either India or anywhere in the world.

You must send your passport directly to the IRS to confirm your ITIN application. If you send a copy or work with non-IRS agents, you will have little chance of getting ITIN. So we have found a nice website (CAA) for you by doing the necessary research. The website we share gives a 100% money back guarantee. So they will refund your money in case you cannot get your ITIN.

JUST CLICK HERE to go to this website which gives you 100% guarantee. (You can use the coupon code “ETICARET50” to get $50 off.)

Answer the questions on the form correctly after visiting to the websites. They will contact you by e-mail after making the payment.

NOTE: The IRS agent will refund your money if you do not receive your ITIN.

Application process

After making the payment online on their website, an IRS agent will contact you to verify your passport and submit a copy to the IRS. The entire process is conducted online. Your ITIN application may take 6–8 weeks to process.

You should expect to return to the IRS about your approval status after not more than twenty weeks; once your application has been approved, you will receive a letter with your ITIN.

Good luck!